On Thursday, Ukraine and Russia announced another prisoner exchange, marking the third such agreement this week as part of a settlement reached during peace negotiations in Turkey.

During last week’s discussions in Istanbul, both parties consented to release over 1,000 prisoners each, with all individuals being either injured or under 25 years of age, as well as to return the remains of soldiers who lost their lives in combat.

“Today, the heroes from our Armed Forces, National Guard, and Border Guard Service have returned home,” stated Ukrainian President Volodymyr Zelensky in a social media update. He noted that “they all need medical attention,” referring to the returning servicemen as “severely injured and seriously ill.”

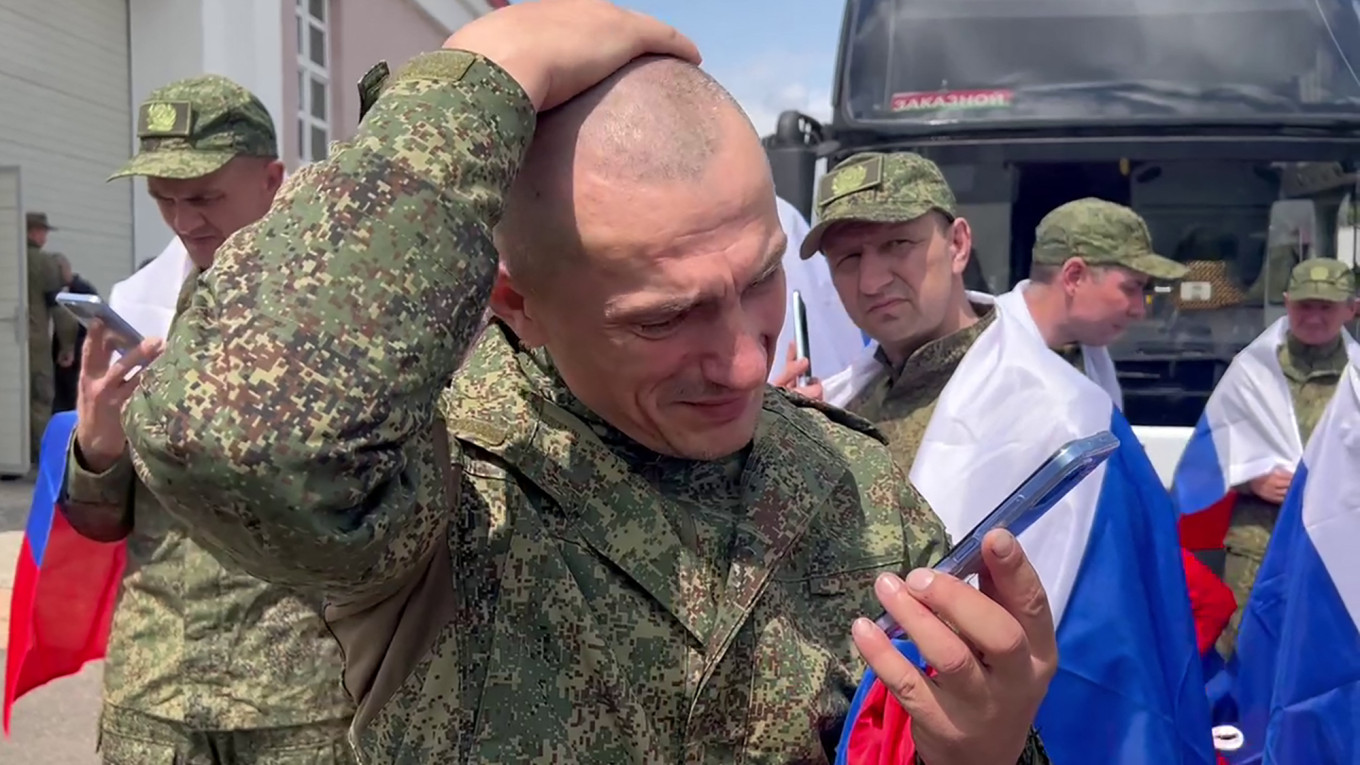

The Russian Defense Ministry also verified the prisoner swap, indicating that a group of Russian soldiers had been repatriated from Ukraine and are currently in Belarus.

“We are continuing our efforts to secure the release of all individuals held in Russian captivity,” Zelensky affirmed. “We appreciate everyone who contributes to facilitating these exchanges — enabling each and every one of them to return home to Ukraine.”

He shared images of the freed soldiers, many adorned in Ukrainian flags with freshly shaven heads. The oldest was reported to be 59 years old and the youngest just 22, as per Ukrainian ombudsman Dmytro Lubinets. Some of these individuals had previously been reported missing in action.

In contrast, Russian state media showcased the returning troops wrapped in Russian flags, chanting “Russia.”

These exchanges represent the only significant achievement from two recent rounds of peace discussions held in Istanbul. To date, Russia has dismissed requests for an unconditional ceasefire, insisting that Ukraine relinquish its NATO aspirations and give up occupied territories.

On Wednesday, Russia transferred the remains of 1,212 Ukrainian soldiers who died during the conflict.