Russia will require at least a decade to meaningfully boost its gas exports to China through the forthcoming Power of Siberia 2 pipeline, as reported by Reuters on Tuesday.

This long-awaited, multi-billion-dollar initiative is a key part of Russia’s strategy to shift its gas export focus towards Asia after losing numerous Western customers due to the invasion of Ukraine.

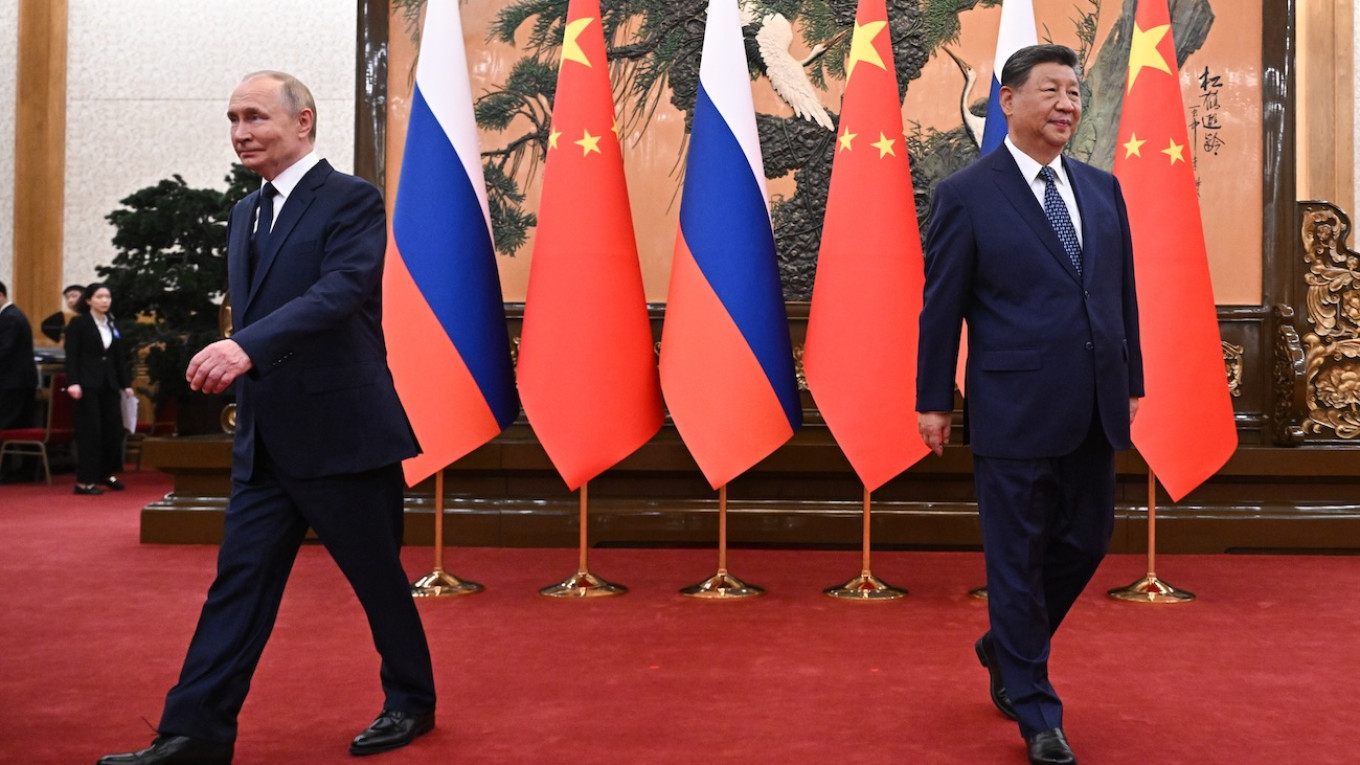

Gazprom, the state-controlled energy behemoth of Russia, announced it had secured a “legally binding” agreement with China regarding Power of Siberia 2 during President Vladimir Putin’s recent trip to Beijing.

However, the two nations could not reach a consensus on crucial issues such as gas pricing, investment terms, or the delivery timeline, according to Reuters.

Even assuming an agreement is reached next year, the construction phase is expected to take a minimum of five years, with an additional five years needed to achieve full operational capacity, as indicated by two industry insiders.

Another industry source mentioned that Gazprom does not foresee the pipeline achieving even half of its capacity prior to 2034-35 if gas deliveries commence in 2031.

Currently, Gazprom supplies China with 38 billion cubic meters (bcm) of gas annually via the Power of Siberia 1 pipeline, which began operations in 2019. The company plans to initiate supplies through an alternative route in the Far East in 2027, which would add another 12 bcm per year.

Once completed, Power of Siberia 2 is anticipated to deliver as much as 50 bcm per year to China.

The cost of Russian gas exports to China is considerably lower compared to those for other international clients. According to the Russian Ministry of Economic Development, China is paying approximately $248 per 1,000 cubic meters this year, which is 38% less than the $402 charged to Gazprom’s other customers outside the Commonwealth of Independent States.

The projected price for China next year is set to decrease to $240, about 37% lower than the average export price of $380.

At present, sales to China constitute only about one-fifth of Gazprom’s previous European exports, which have diminished by a factor of twelve since the onset of the invasion.

In the first half of 2025, Gazprom delivered merely 8.8 bcm of gas to Europe, with total annual exports expected to barely surpass 16 bcm, which is the maximum capacity of the European section of the TurkStream pipeline.

This outcome would represent the lowest levels of Russian gas deliveries to Europe since the early 1970s.

Before the invasion, Gazprom’s exports to Europe peaked at around 200 bcm annually.