Thames Water may require up to £10 billion in both debt and equity to stabilize its financial standing, as revealed by a creditor representative seeking to provide the beleaguered utility with an additional £3 billion.

During a hearing on Tuesday at London’s High Court, evidence emerged indicating that the UK’s largest water provider may need far more financial support than the previously suggested £6.3 billion.

This testimony highlights the severity of the financial challenges faced by the water company as it seeks court approval for emergency funding to avert the risk of temporary nationalization.

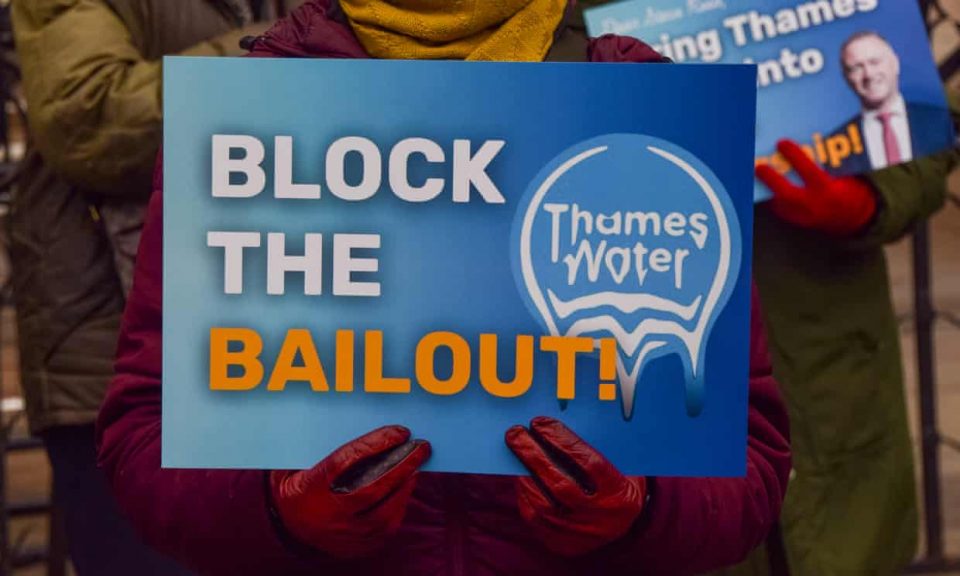

Thames Water is nearing a collapse that would compel the government to assume control through a special administration process to ensure water and sewage services remain operational for 16 million households and businesses in London and the southeast—nearly 25% of the UK’s population.

The court was informed on Tuesday that Thames Water is expected to incur consultancy fees amounting to £200 million in the first half of the year, according to Chief Financial Officer Alastair Cochran. He clarified that these expenses would be covered by creditors rather than customers, which include investment bank Rothschild, currently searching for a new purchaser, and law firm Linklaters.

The ongoing funding crisis has heightened governmental pressure to consider temporary nationalization, amid rising complaints over substantial bill hikes and widespread concerns about sewage pollution in UK rivers and seas.

Last summer, Thames indicated that one scenario would require £3.3 billion in equity, distinct from the £3 billion in debt currently under judicial review. Nevertheless, experts have asserted that the utility may need considerably more funds to secure a stable operational future.

A crowded courtroom heard supporting evidence from David Burlison, a restructuring specialist at investment bank Jefferies, who represents a significant portion of Thames’s bondholders. He stated, “The business will necessitate a recapitalization in the neighborhood of £6 billion to £10 billion.”

The projected £10 billion would cater to various needs, including unanticipated expenses, regulatory penalties, and the infusion of sufficient new capital to reduce the firm’s debt to a level acceptable to regulatory bodies and credit rating agencies.

Julian Gething, Thames Water’s chief restructuring officer, remarked, “For any recapitalization of Thames Water to be viable, it must achieve an investment-grade credit rating to fulfill regulatory mandates and allow us to continue investing billions in enhancing our network’s resilience for our customers’ benefit.”

The court is expected to decide on the approval of up to £3 billion in urgent debt funding. Thames Water has indicated that it will deplete its cash reserves by the end of March without this financial support from around 100 large investors, represented by Burlison, who currently hold class A debt.

The class A cohort consists of prominent investors involved in UK infrastructure, some of whom might consider acquiring Thames in the future. This point has been emphasized in communications with Ofwat and the government, according to sources familiar with the discussions.

There are concerns that substantial write-downs could lead to increased investment costs across all UK water and infrastructure, should the risk profile for UK assets change due to the handling of Thames Water. However, others have suggested that the risk of broader contagion may be exaggerated.

Conflict exists between the class A investors and the holders of class B debt, who claim their agreement is more economical and that the class A creditors are attempting to establish control over Thames for their own interests. Conversely, the company has criticized the class B investors for a “shambolic” strategy that lacks viability, as outlined in their written court submissions on Monday.

The hearing involves billions of pounds in potential ramifications. An independent report prepared for the court by Teneo, a consultancy, estimated last month that class A investors would face a £5 billion loss if the company entered special administration, compared to a potential loss of £2.8 billion if the restructuring agreement goes ahead.